All Categories

Featured

Table of Contents

- – What are the benefits of Indexed Universal Lif...

- – What does a basic Indexed Universal Life plan ...

- – How do I get High Cash Value Indexed Universa...

- – What types of Iul Policy are available?

- – What is the best Indexed Universal Life Grow...

- – What are the top Guaranteed Indexed Universa...

- – How does Iul Investment work?

The plan obtains worth according to a repaired routine, and there are less costs than an IUL plan. A variable plan's cash money worth might depend on the performance of details stocks or various other safety and securities, and your premium can additionally alter.

An indexed universal life insurance policy plan consists of a survivor benefit, as well as an element that is connected to a stock market index. The cash value development depends upon the performance of that index. These policies use greater potential returns than other forms of life insurance coverage, as well as greater threats and extra costs.

A 401(k) has even more investment options to select from and may come with a company match. On the other hand, an IUL comes with a death benefit and an extra cash money value that the insurance holder can obtain versus. They also come with high premiums and charges, and unlike a 401(k), they can be terminated if the insured stops paying into them.

What are the benefits of Indexed Universal Life For Retirement Income?

These policies can be much more complicated compared to various other types of life insurance policy, and they aren't always best for every financier. Speaking to an experienced life insurance policy agent or broker can help you choose if indexed global life insurance policy is a great fit for you. Investopedia does not supply tax obligation, financial investment, or financial solutions and guidance.

FOR FINANCIAL PROFESSIONALS We have actually made to provide you with the very best online experience. Your existing web browser may restrict that experience. You might be using an old web browser that's in need of support, or setups within your web browser that are not compatible with our site. Please conserve on your own some stress, and update your internet browser in order to watch our website.

What does a basic Indexed Universal Life plan include?

Already using an upgraded browser and still having difficulty? Please offer us a call at for more help. Your present web browser: Detecting ...

Your financial scenario is distinct, so it's crucial to discover a life insurance policy item that fulfills your particular demands. If you're searching for lifetime insurance coverage, indexed universal life insurance is one alternative you may intend to take into consideration. Like various other irreversible life insurance policy products, these policies enable you to develop cash money worth you can touch throughout your life time. Indexed Universal Life financial security.

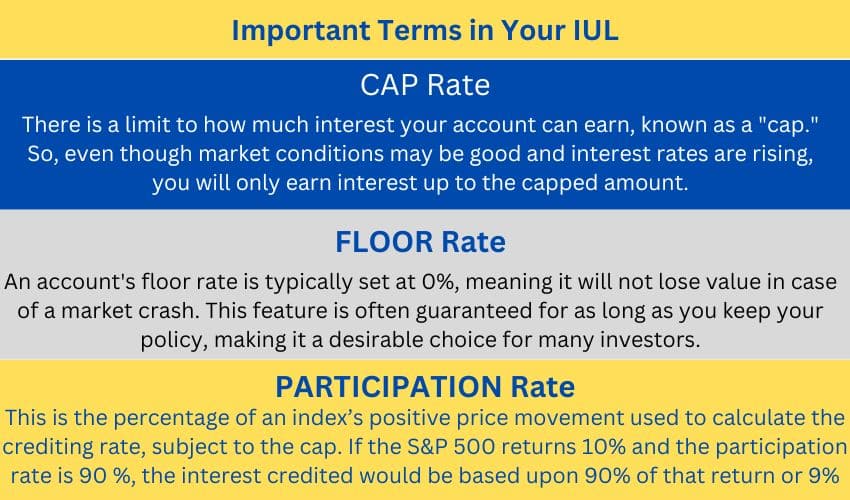

That indicates you have extra long-term growth capacity than a whole life policy, which supplies a fixed price of return. Normally, IUL plans avoid you from experiencing losses in years when the index loses worth.

As long as you pay the premiums, the policy remains in force for your whole life. You can collect money value you can utilize throughout your life time for various monetary demands.

How do I get High Cash Value Indexed Universal Life?

Permanent life insurance coverage plans usually have higher initial premiums than term insurance coverage, so it might not be the right option if you're on a limited budget. IUL retirement planning. The cap on passion debts can restrict the upside potential in years when the supply market carries out well. Your policy might lapse if you obtain too big of a withdrawal or policy financing

With the potential for more robust returns and flexible repayments, indexed global life insurance policy might be an alternative you desire to take into consideration., that can evaluate your individual circumstance and supply tailored understanding.

Ideal for ages 35-55.: Deals flexible coverage with moderate cash money worth in years 15-30. Some points customers need to think about: In exchange for the fatality advantage, life insurance products charge fees such as death and expenditure danger charges and abandonment fees.

Insurance policy holders could lose money in these items. Policy car loans and withdrawals might produce a negative tax obligation result in the event of lapse or plan surrender, and will lower both the abandonment worth and fatality advantage. Withdrawals might undergo tax within the first fifteen years of the contract. Customers ought to consult their tax obligation expert when thinking about taking a plan finance - IUL.

What types of Iul Policy are available?

Minnesota Life Insurance Policy Firm and Securian Life Insurance policy Company are subsidiaries of Securian Financial Team, Inc.

What is the best Indexed Universal Life Growth Strategy option?

IUL can be made use of to save for future requirements and supply you with a home loan or a safe retired life planning automobile. IUL offers you cash value development in your lifetime with stock market index-linked investments but with capital security for the rest of your life.

To recognize IUL, we initially require to break it down right into its core parts: the money value part the survivor benefit and the cash worth. The fatality benefit is the quantity of cash paid to the policyholder's beneficiaries upon their passing away. The plan's cash-in value, on the other hand, is an investment component that grows gradually.

What are the top Guaranteed Indexed Universal Life providers in my area?

Whilst plan withdrawals are useful, it is vital to monitor the plan's performance to guarantee it can maintain those withdrawals. Some insurers additionally limit the amount you can withdraw without reducing the fatality advantage quantity.

The economic security needed focuses on the capacity to take care of premium payments easily, also though IUL policies supply some flexibility.: IUL policies enable adjustable costs payments, giving policyholders some flexibility on how much and when they pay within established limits. Regardless of this adaptability, consistent and ample financing is necessary to maintain the plan in excellent standing.: Policyholders ought to have a secure income or adequate savings to ensure they can meet premium needs in time.

How does Iul Investment work?

You can pick to pay this passion as you go or have the rate of interest roll up within the policy. If you never pay back the finance throughout your life time, the survivor benefit will be minimized by the quantity of the impressive funding. It suggests your recipients will obtain a lower quantity so you might wish to consider this before taking a policy loan.

It's essential to monitor your money value balance and make any essential modifications to stop a plan lapse. Life plan estimates are a vital tool for comprehending the potential efficiency of an IUL policy. These estimates are based on the predicted rate of interest, charges, payments, caps, involvement price, interest rates used, and fundings.

Table of Contents

- – What are the benefits of Indexed Universal Lif...

- – What does a basic Indexed Universal Life plan ...

- – How do I get High Cash Value Indexed Universa...

- – What types of Iul Policy are available?

- – What is the best Indexed Universal Life Grow...

- – What are the top Guaranteed Indexed Universa...

- – How does Iul Investment work?

Latest Posts

Aseguranza Universal

Whole Life Vs Indexed Universal Life

Index Universal Life Insurance Calculator

More

Latest Posts

Aseguranza Universal

Whole Life Vs Indexed Universal Life

Index Universal Life Insurance Calculator